How to Organize Trading Strategies with Channels (Step-by-Step)

How to Organize Trading Strategies with Channels

Now that you've recorded your first trade, it's time to learn about one of SyncTrade's most powerful organizational features: Channels. Channels help you categorize trades by strategy, timeframe, or purpose, making it easier to analyze performance and identify what's working in your trading approach.

Time: 4 minutes (Set up your first trading channels)Think of channels as folders for your trades - instead of having all trades mixed together, you can organize them by your trading strategy, risk level, or any system that makes sense for your approach. This organization becomes invaluable as your trading activity grows.

What Are Trading Channels in a Trading Journal?

Understanding Channel Basics

- Definition: Channels are labels that categorize your trades for better organization and analysis

- Purpose: Help you track performance across different strategies or approaches

- Visibility: Appear in your trades list and analytics dashboards

- Flexibility: Can be assigned during trade creation or added to existing trades

Why Should You Use Channels?

- Performance Comparison: See which strategies are most profitable

- Risk Management: Track high-risk vs conservative approaches separately

- Learning Tool: Identify patterns in successful vs unsuccessful trade types

- Portfolio Organization: Separate different trading goals or timeframes

Trades organized by channels for easy strategy comparison.

Best Ways to Organize Your Trading Journal

By Trading Source (Highly Recommended)

One of the most effective ways to organize trades is by tracking where your trade ideas come from, especially if you follow multiple paid services or subscription platforms.

Subscription Services Tracking

- "Telegram - [Service Name]": Track trades from specific Telegram channels or groups

- "Liquide Subscription": Monitor performance of trades from Liquide platform recommendations

- "Uninvest Premium": Separate channel for Uninvest subscription-based trades

- "Free Signals": Distinguish between paid and free trade recommendations

- "Multiple Sources": For trades combining signals from different platforms

Platform-Specific Examples

- "TG - Alpha Signals": Telegram channel subscription trades

- "TG - Bull Run Club": Another Telegram trading group

- "Liquide Pro Tips": Premium Liquide service trades

- "Uninvest Weekly": Weekly picks from Uninvest subscription

- "Discord - Traders Hub": Discord community recommendations

- "YouTube - [Creator Name]": Trades based on YouTube stock analysis

By Trading Style & Timeframe

- "Intraday Calls": Same-day entry and exit trades from any source

- "Swing Picks": Multi-day positions from subscription services

- "Long-term Investments": Buy-and-hold recommendations

- "Options Strategies": If following options-focused services

By Risk & Capital Allocation

- "High Conviction": Premium service recommendations with high confidence

- "Experimental": Testing new services or unproven sources

- "Conservative Picks": Low-risk recommendations from trusted sources

- "Small Cap Bets": Higher-risk small-cap recommendations

Performance Tracking Benefits

Using source-based channels helps you:

- Evaluate Subscription ROI: See which paid services actually generate profits

- Track Success Rates: Compare win rates across different signal providers

- Optimize Spending: Cancel underperforming subscriptions, invest more in successful ones

- Attribution Analysis: Know exactly where your best trades originated

- Cost-Benefit Analysis: Calculate if subscription fees are justified by profits

Maximizing Subscription Service Value

Before You Subscribe

Use channels to test services smartly:

- Trial Period Tracking: Create temporary channels for trial subscriptions

- Paper Trading: Test recommendations without real money first

- Free Content Evaluation: Track free calls before paying for premium

- Community Research: Check reviews and track records before subscribing

Optimizing Your Subscription Portfolio

The 80/20 Rule for Subscriptions

- Often 20% of your subscriptions generate 80% of your profits

- Use channel data to identify and focus on top performers

- Cancel underperforming subscriptions ruthlessly

Subscription Budget Management

- Total Rule: Keep subscription costs under 5% of your monthly trading budget

- ROI Target: Each subscription should generate 10x its cost in profits

- Regular Review: Evaluate subscriptions quarterly based on channel performance

Channel-Based Decision Framework

Keep Subscription If:

- Channel shows consistent profitability over 3+ months

- Win rate exceeds 60% for swing trades, 55% for intraday

- Net profit (after fees) exceeds 10x subscription cost

- Risk-adjusted returns beat market average

Cancel Subscription If:

- Channel shows losses over 2+ consecutive months

- Win rate below 45% consistently

- Net profit doesn't cover subscription cost

- Better free alternatives identified through tracking

Advanced Subscription Tracking

Multi-Service Strategy

Some experienced traders use channels to track:

- "Consensus Plays": Trades recommended by 3+ services

- "Divergent Bets": When services disagree, track which is right

- "Service A vs Service B": Direct performance comparisons

- "Combined Strategies": Mixing signals from different sources

This systematic approach helps you build a profitable, cost-effective subscription portfolio based on actual data rather than marketing promises.

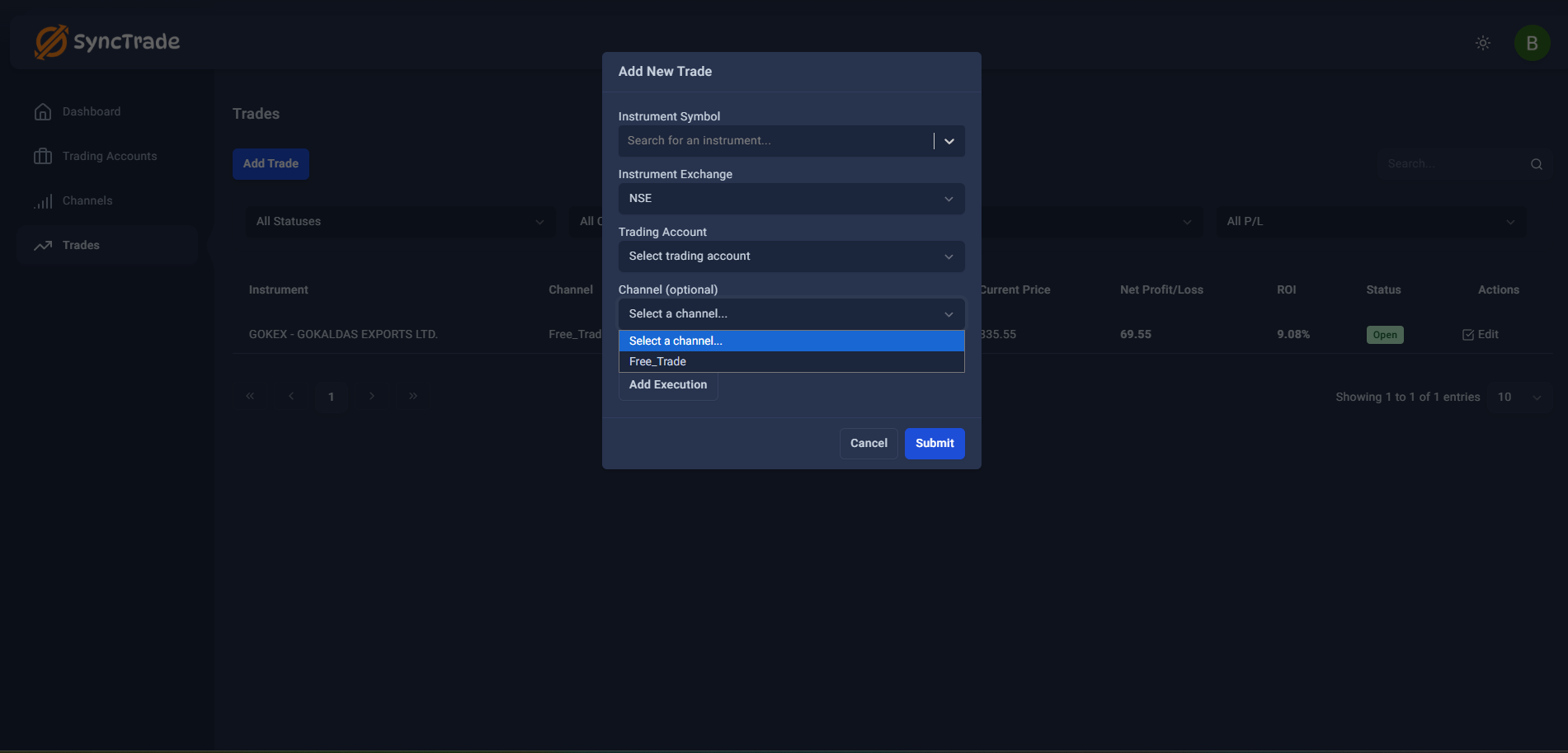

Select or create channels when adding new trades.

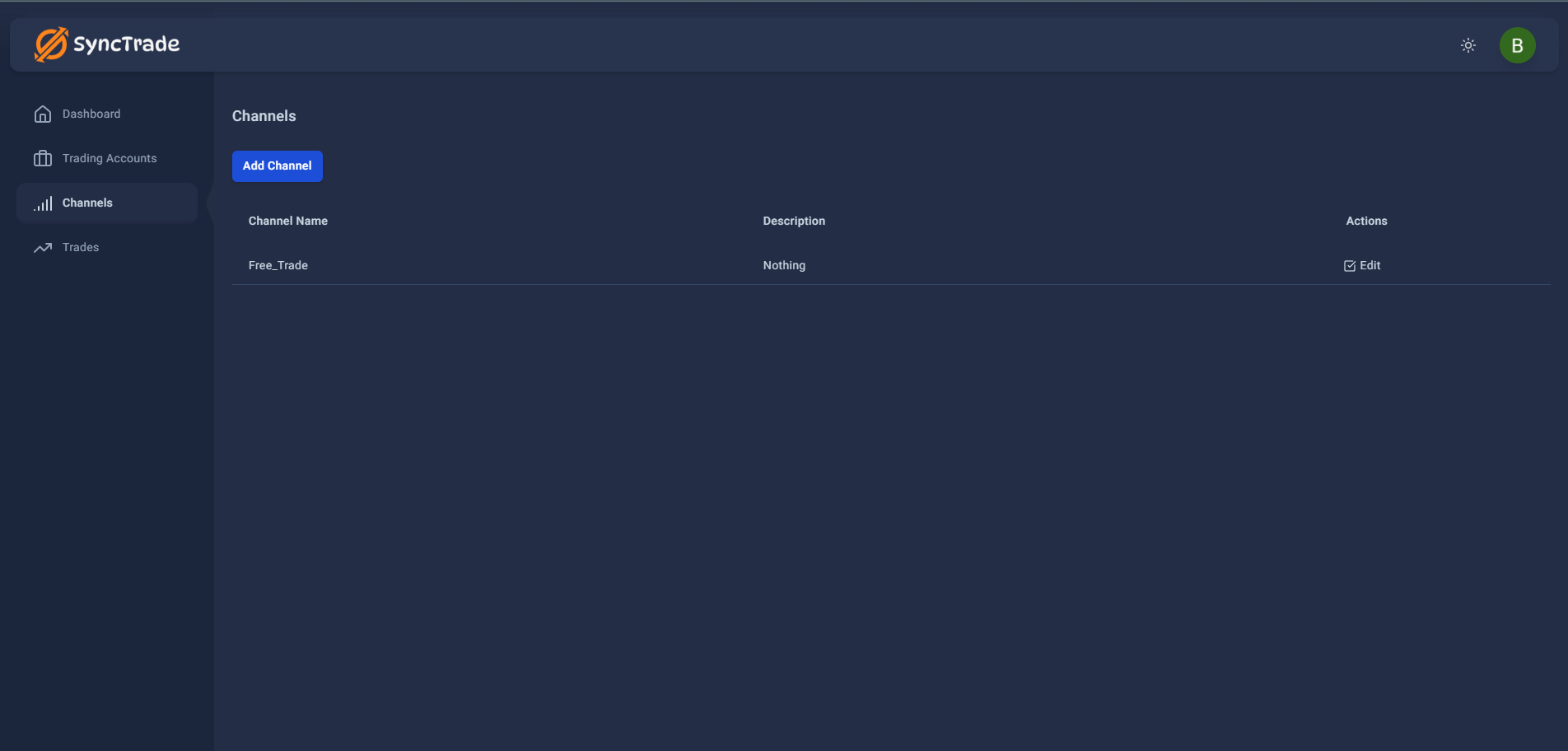

Creating and Managing Channels

Step 1: Open the Channels Dashboard

SyncTrade provides a dedicated Channels section for organizing your trading strategies.

- Navigation: Sidebar → Channels

- Overview: See all existing channels with names, descriptions, and actions

- Management: Edit existing channels or create new ones

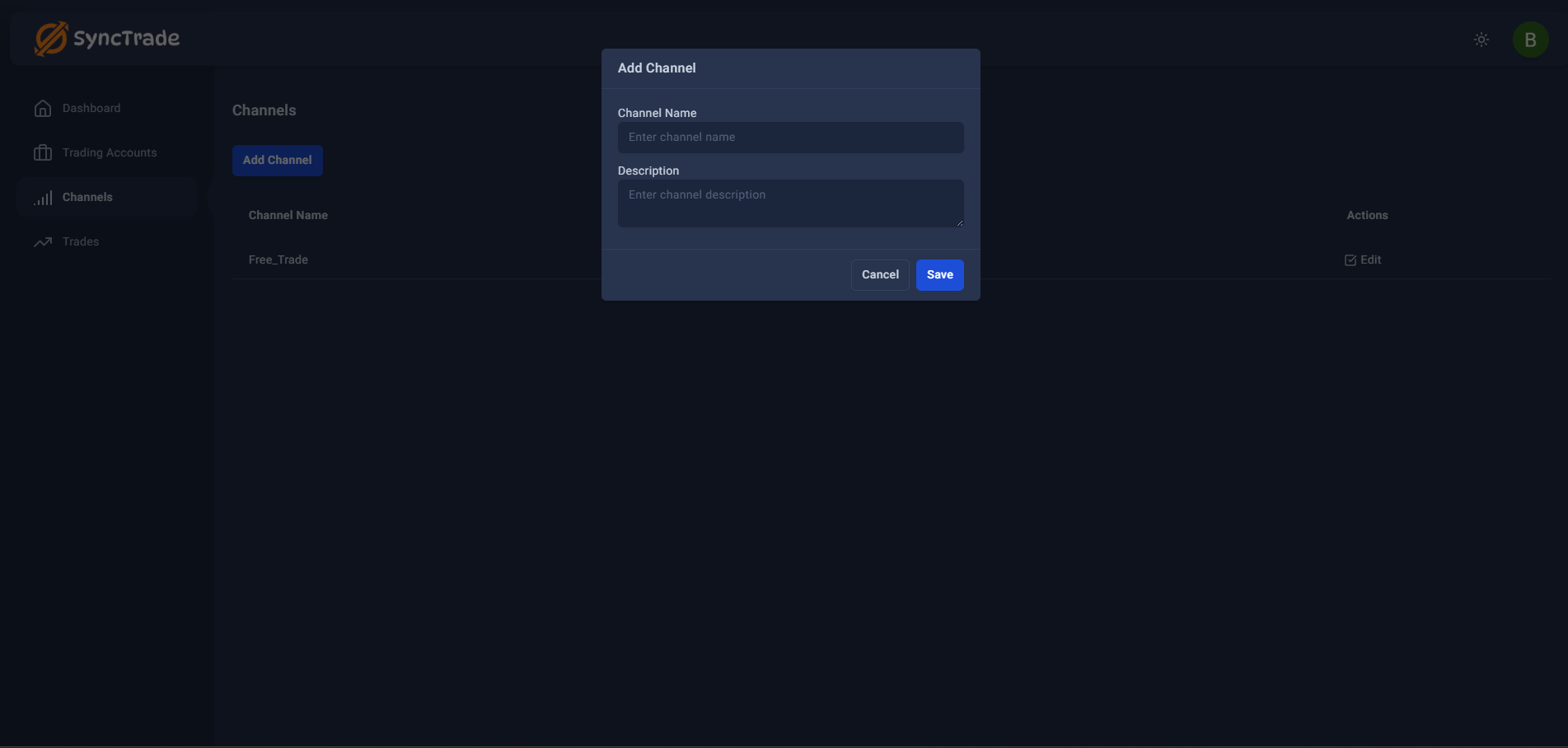

Step 2: Add a New Strategy Channel

To add a new channel for organizing your trades:

- Action: Click the blue "Add Channel" button

- Result: "Add Channel" dialog opens with required fields

Create new channels with descriptive names and clear descriptions.

Step 3: Define Your Strategy Details

Complete the channel creation form with meaningful information:

Channel Name (Required)

- Purpose: Short, descriptive identifier for your strategy

- Examples: "Long-term Growth", "Swing Trading", "High Risk Plays"

- Best Practice: Use clear names you'll understand months later

- Format: Keep it concise but descriptive

Description (Optional but Recommended)

-

Purpose: Detailed explanation of the channel's trading strategy

-

Examples:

- "Conservative long-term investments in blue-chip stocks"

- "Short-term momentum trades based on technical analysis"

- "High-risk speculative positions with small capital allocation"

-

Best Practice: Include strategy criteria, risk level, and typical holding period

-

Step 4: Save Your Channel

-

Review: Double-check the channel name and description

-

Action: Click "Save" to create the channel

-

Cancel: Use "Cancel" if you want to abort channel creation

-

Result: New channel appears in your channels list and becomes available for trade assignment

Channel Management Best Practices

Effective Channel Names

Based on the interface, here are proven naming strategies:

Strategy-Based Names

- "Momentum Breakouts" - Technical analysis based trades

- "Value Investing" - Fundamental analysis picks

- "Dividend Income" - Regular income generation

- "Growth Stocks" - High-growth potential companies

Risk-Based Names

- "Conservative Portfolio" - Low-risk, stable positions

- "Moderate Risk" - Balanced risk-reward trades

- "Speculative Plays" - High-risk, high-reward positions

- "Experimental Trades" - Testing new strategies

Timeframe-Based Names

- "Intraday Trading" - Same-day buy and sell

- "Swing Positions" - Multi-day technical setups

- "Long-term Holdings" - Buy-and-hold investments

- "Quarterly Plays" - Earnings-based trades

Descriptive Channel Descriptions

Make your descriptions specific and actionable:

Good Description Examples:

-

"Blue Chip Dividends": "Large-cap dividend-paying stocks held for 1+ years. Focus on consistent dividend growth and capital preservation. Maximum 3% of portfolio per position."

-

"Technical Breakouts": "Momentum trades based on chart patterns and volume. Entry on breakout confirmation, stop-loss at 5%, target 15% gain. Hold 2-4 weeks maximum."

-

"Value Recovery": "Undervalued stocks trading below intrinsic value. Fundamental analysis based. 6-18 month holding period. Focus on companies with strong balance sheets."

Avoid Vague Descriptions:

- ❌ "Good stocks" - Not specific enough

- ❌ "Strategy 1" - Doesn't explain the approach

- ❌ "Random trades" - No clear criteria

Using Your Channels Effectively

Channel Assignment During Trade Entry

When recording trades, your created channels will appear in the dropdown:

- Location: Trade creation → Channel (optional) field

- Selection: Choose from your created channels

- Consistency: Always assign channels for better organization

- New Trades: All future trades can use your channel system

Editing Existing Channels

From the Channels page, you can modify your strategy categories:

- Access: Click "Edit" button next to any channel

- Modify: Update channel name or description

- Impact: Changes apply to all trades using that channel

- Caution: Renaming channels affects historical trade organization

Real-World Channel Templates

Subscription Tracker Template (Recommended for Active Traders)

Perfect for traders following multiple paid services and wanting to track ROI:

-

Channel Name: "TG - Premium Signals" Description: "Main Telegram subscription (₹2,000/month). Intraday + swing calls. Target: Beat subscription cost by 5x minimum."

-

Channel Name: "Liquide Pro Picks" Description: "Liquide premium service recommendations. Focus on mid-cap growth stocks. 3-6 month holding typical."

-

Channel Name: "Uninvest Research" Description: "Uninvest subscription trades based on detailed fundamental analysis. Small-cap focus with 12+ month outlook."

-

Channel Name: "Free Community" Description: "Compiled free signals from various YouTube, Discord, and public Telegram groups. No cost, higher risk."

-

Channel Name: "Personal Analysis" Description: "Own research and analysis trades. No external influence. Track independent decision-making success."

Multi-Source Trader Template

For traders combining multiple information sources:

-

Channel Name: "High-Conviction Calls" Description: "Trades recommended by 2+ sources. Premium Telegram + Liquide agreement. Higher capital allocation."

-

Channel Name: "Single Source Bets" Description: "Trades from only one recommendation source. Smaller position sizes for testing."

-

Channel Name: "Contrarian Plays" Description: "Trades going against popular opinion or community sentiment. Independent analysis required."

-

Channel Name: "News-Based Trades" Description: "Trades based on breaking news, earnings, or events. Not from subscription services."

Cost-Conscious Template

For traders wanting to minimize subscription costs while maximizing returns:

-

Channel Name: "Proven Paid Service" Description: "Only the best-performing subscription after testing multiple services. Currently [Service Name]."

-

Channel Name: "Free Signal Testing" Description: "Testing free sources to potentially replace paid subscriptions. Track performance vs. cost."

-

Channel Name: "Trial Subscriptions" Description: "Testing new paid services during trial periods before committing to full subscriptions."

-

Channel Name: "Self-Research" Description: "Developing independent analysis skills to reduce dependency on subs

Using Channels for Performance Analysis

Channel-Based Insights

Once you have trades organized by channels, you can:

- Compare ROI: See which strategies generate best returns

- Analyze Win Rates: Identify most consistent approaches

- Track Risk: Monitor which channels have highest volatility

- Time Analysis: Determine optimal holding periods by strategy

Making Data-Driven Decisions

Use channel performance to:

- Increase Focus: Spend more time on profitable strategies

- Reduce Exposure: Limit capital in underperforming approaches

- Optimize Allocation: Balance portfolio across successful channels

- Learn Patterns: Understand what makes certain strategies work

Channel Best Practices

Naming Conventions

- Use clear, descriptive names ("Blue Chip Stocks" not "Channel A")

- Keep names concise but meaningful

- Use consistent capitalization and formatting

- Avoid special characters that might cause display issues

Organization Tips

- Don't Over-Categorize: Start with few channels, add more as needed

- Review Regularly: Evaluate if your channel system still makes sense

- Update Historical Trades: Assign channels to older trades for complete analysis

- Document Strategy: Keep notes on what each channel represents

Strategic Usage

- Test New Approaches: Use experimental channels for new strategies

- Track Market Conditions: Create channels for different market environments

- Monitor Account Goals: Separate channels for different financial objectives

- Family Organization: Use channels to track trades by family member

What's Next

What's Next?

Channel Setup Checklist

- Decided on 3-5 initial channel categories ✅

- Created first channels during trade entry

- Assigned channels to existing trades

- Understood channel naming best practices

- Ready to analyze performance by strategy

Tips for Success

- Start Small: Begin with just 3-4 channels to avoid overwhelm

- Be Patient: Channel benefits become clear after 10-20 trades

- Stay Consistent: Always assign channels to maintain organization

- Review Monthly: Evaluate channel performance to improve strategies

Troubleshooting

Channel Examples by Trader Type

Conservative Investor

- "Blue Chip Stocks" - Large, stable companies

- "Dividend Income" - Regular dividend payers

- "Index Funds" - Market tracking investments

- "Bond Equivalent" - Very low risk positions

Growth-Focused Trader

- "Tech Growth" - Technology sector growth stocks

- "Small Cap Gems" - Emerging small companies

- "Sector Leaders" - Market-leading companies in growing sectors

- "International Growth" - Global growth opportunities

Technical Analyst

- "Breakout Plays" - Chart pattern based trades

- "Momentum Trades" - Trend following positions

- "Support/Resistance" - Key level based trades

- "Moving Average Plays" - Technical indicator based entries

Event-Driven Trader

- "Earnings Plays" - Quarterly results based trades

- "News Events" - Current events trading

- "Merger Arbitrage" - Corporate action based trades

- "IPO Plays" - New listing opportunities

Start with the channel structure that matches your current trading style, and evolve it as you develop new strategies and approaches.

Frequently Asked Questions (FAQ)

How many channels should I create?

Start with 3-5 channels. You can always add more as your trading evolves and you identify new strategies.

Can I change a trade's channel after saving?

Yes, you can edit any trade and change its channel assignment at any time.

What if I forget to assign a channel to a trade?

Trades without channels will still function normally, but you'll miss out on the organizational and analytical benefits.

Should I create separate channels for different stocks?

Generally no - channels should represent strategies or approaches, not individual stocks. Multiple stocks can belong to the same strategic channel.

Can I delete or rename channels later?

Most platforms allow channel management, but check what happens to trades assigned to deleted channels.